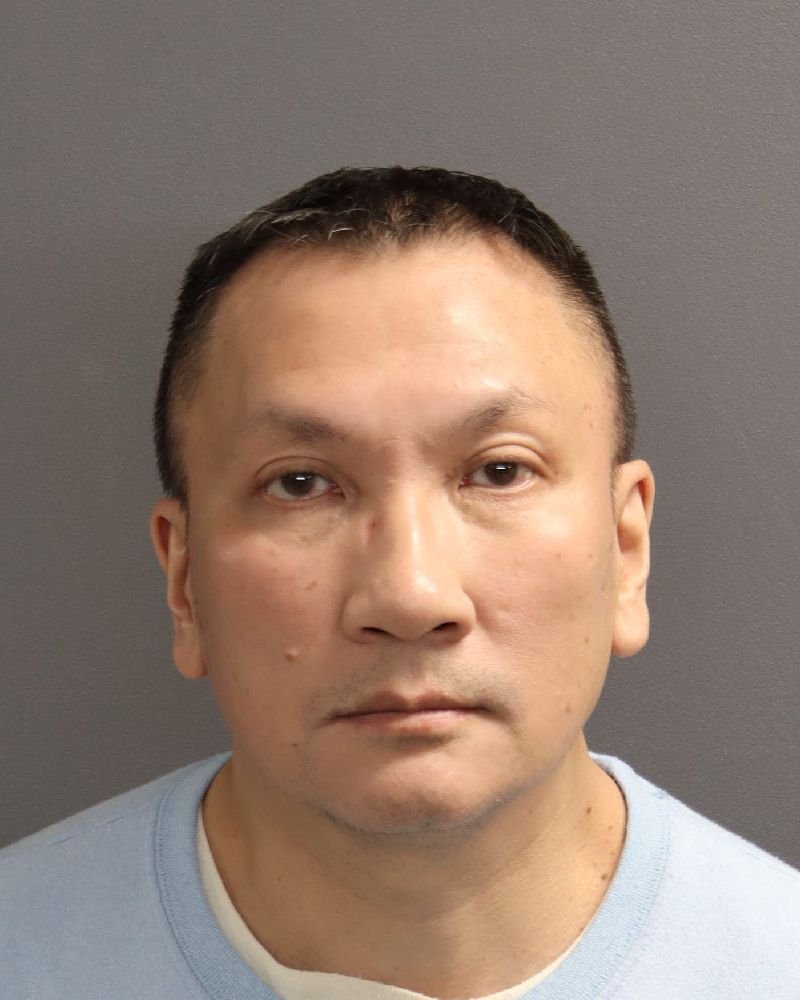

Burnsville Man Sentenced in Apple Valley Fraud Case, To Serve Concurrently With 7-Year Federal Prison Term

Provided by Dakota County Jail.

DAKOTA COUNTY, MINNESOTA: A Burnsville man already serving a lengthy federal prison sentence for a multimillion-dollar fraud scheme has received a downward durational sentence in a separate Dakota County financial crime case tied to fraudulent loan documents used at Wings and Royal Credit Union in the south metro.

Thomas Thanh Pham, 53, was sentenced on January 12, 2026, in Dakota County District Court after pleading guilty to Theft by Swindle – Property Value Over $35,000, a felony offense. The case stems from a financial fraud investigation originating in Apple Valley, Minnesota.

Pham was sentenced to 33 months in prison following the court granting a downward durational departure, allowing the state sentence to run concurrently with the 84-month federal prison sentence he is already serving.

Apple Valley Theft-by-Swindle Investigation

The Dakota County case began after employees at an Apple Valley financial institution flagged suspicious activity connected to a home equity line of credit (HELOC) application submitted by Pham in November 2024.

According to the criminal complaint, Pham disclosed that he had an outstanding civil judgment against him, a factor that would normally prevent loan approval. To overcome that obstacle, investigators say Pham submitted what appeared to be official settlement documentation indicating the judgment had been resolved for a reduced amount.

That documentation was later determined to be fraudulent.

Based on the false settlement letter, the Apple Valley bank approved the HELOC and disbursed more than $35,000 on or about November 6, 2024. Records show the funds were used to pay off other debts, and that Pham quickly accessed additional cash shortly after the loan was issued.

Following the disbursement, bank employees conducted an internal review after noticing inconsistencies in the settlement paperwork. Investigators contacted the actual judgment holder, who confirmed:

No settlement agreement had been reached

No payment had been received

The settlement letter provided to the bank was not authentic

Bank officials later told investigators that the loan would not have been approved if the documentation had been legitimate.

The investigation further revealed that Pham used a nearly identical scheme at a second south metro financial institution, again disclosing an outstanding judgment while submitting another fabricated settlement letter to falsely represent that the debt had been resolved. That second bank also confirmed loan approval hinged on the fraudulent documentation.

Law enforcement documented that Pham’s conduct involved intentional misrepresentation, the use of false written instruments, and a pattern of deceptive behavior consistent with prior fraud convictions. Investigators noted Pham moved quickly to access and distribute funds, limiting the banks’ ability to recover losses.

Plea Agreement and Sentencing

Pham ultimately pleaded guilty to Theft by Swindle – Property Value Over $35,000, admitting he knowingly submitted false settlement documentation to induce financial institutions to release funds. A second count of theft by swindling was dismissed as part of the plea agreement.

At sentencing, Judge Kelly Staples committed Pham to the Minnesota Commissioner of Corrections for 33 months but approved a downward durational departure at the defendant’s request, allowing the sentence to be served concurrently with his federal prison term. As a result, Pham will remain in Bureau of Prisons custody rather than being transferred to a Minnesota state facility.

The court reserved the issue of restitution, which will be calculated by Dakota County Community Corrections and is expected to include repayment to the affected financial institutions.

Connection to Federal Fraud Case

The state sentence runs concurrently with Pham’s 84-month federal prison sentence, imposed in U.S. District Court in Minneapolis, where he was convicted of orchestrating a nearly $3 million fraud scheme targeting a California-based electronics manufacturer.

As Limitless Media previously reported, Burnsville Man Sentenced to 7 Years in Prison for Multi-Million Dollar Fraud Scheme Targeting Electronics Manufacturer: Between 2019 and 2020, Pham used his company, Enterprise Products, LLC, to pose as a broker capable of securing lucrative electronics repair and manufacturing contracts. Prosecutors said Pham staged meetings, provided fake contracts, and enlisted an associate, a fellow former federal inmate, to pose as a corporate executive.

The scheme escalated when Pham convinced the victim company to wire a $1.27 million “deposit bond”, supported by falsified contracts and documents. He further shipped stolen electronic devices as supposed “repair samples” to build credibility, while misappropriating the funds and offering repeated delays and excuses.

U.S. District Judge Joan N. Ericksen sentenced Pham to seven years in federal prison, followed by three years of supervised release, and ordered him to pay $2,943,840 in restitution. During sentencing, Judge Ericksen described Pham as “an efficient and effective perpetrator of fraud” and immediately remanded him into custody, citing public safety concerns.

Provided by Sherburne County Jail.

Criminal History and Current Status

Court records show that Pham’s Dakota County and federal convictions are part of a long-standing pattern of financial crimes dating back more than two decades.

According to sentencing materials, Pham has multiple prior felony convictions, including:

Felony Conspiracy to Commit Wire Fraud — Federal conviction in the Northern District of Texas (2006)

Felony Check Forgery — Texas state conviction (2004)

Felony Theft of Property — Texas state conviction (2003)

Felony Secure Execution of Document by Deception — Texas state conviction (2002)

These convictions involve similar conduct centered on financial deception, forged or falsified documents, and fraudulent inducement, mirroring the conduct underlying both the Dakota County theft-by-swindle case and the multi-million-dollar federal fraud scheme for which Pham is currently serving a seven-year prison sentence.

Federal prosecutors cited Pham’s extensive criminal history when seeking an executed prison sentence, while the federal sentencing court described him as a serial fraud offender who posed a continued risk of reoffending if not incarcerated.

Pham remains incarcerated at USP Leavenworth in Kansas, where he will serve both his federal sentence and the concurrent Dakota County prison term. Additional restitution determinations in the state case remain pending.

Written by: Will Wight